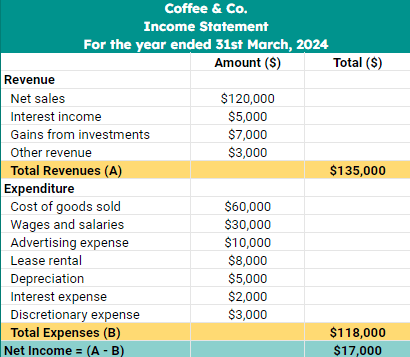

Thus, assertion users can see how much expense is incurred in selling the product and the way a lot in administering the business. Assertion users can even make comparisons with other years’ information for the same enterprise and with different businesses. Nonoperating revenues and bills appear on the backside of the earnings statement because they’re much less vital in assessing the profitability of the enterprise.

Web profit margin signifies the percentage of income that remains as profit in any case expenses, including taxes, have been deducted. The following instance illustrates the format of a typical multi-step revenue assertion. The calculation steps are clarified via the ‘+’ and ‘−’ symbols on the left of various earnings and expense items.

Coming after the gross revenue, we obtained promoting and admin bills that comprise all the secondary costs spent on the product or providers of the corporate. The selling bills are like advertising bills, wage to the salesperson, freight charges, etc. Gross Revenue represents the distinction between gross sales and the worth of goods sold (COGS). It supplies insights into a company’s core operations, excluding different operational expenses. The result after deducting tax bills from earnings earlier than taxes will give you https://www.quickbooks-payroll.org/ the net income, which is the underside line figure indicating the company’s profitability for the period.

In a multi step revenue assertion, enterprise activities are separated into operating activities and non-operating actions. Non-operating gadgets, together with non-operating revenues, non-operating bills, and non-operating features (losses), are shown separately from working revenues and working expenses. With this separation in monetary reporting, you probably can analyze ongoing enterprise operations separately from non-operating items. The third step in getting ready a multi-step earnings assertion entails identifying and recording non-operating revenues and bills. This phase is essential for determining the entire income earlier than taxes, providing a comprehensive view of a company’s financial efficiency beyond its core operations.

Position In Funding Evaluation And Valuation

This gross profit margin shows how profitable a enterprise is, and is an invaluable amount for potential buyers and administration to evaluation. Next, all operating bills together with any administrative and selling expenses are totaled to achieve the entire working expenses. The total operating expenses are then subtracted from the gross revenue to find the total working earnings.

Multi-step revenue statements, then again, use multiple equations to calculate web earnings. In doing so, additionally they calculate gross revenue and working revenue, which aren’t included on a single-step income statement. In comparability, a single-step earnings assertion gives a easy document of monetary activity. The working part is subdivided into two major sections that listing the first business earnings and bills. The first section computes the gross revenue of the business by subtracting the value of items offered from the entire sales. This is a key determine for buyers, collectors, and inside administration because it shows how worthwhile the company is at promoting its items or making its merchandise.

Tips On How To Interpret The Figures In A Multi-step Revenue Assertion

- Throughout this article, readers will encounter not solely a radical examination of every segment however may also be guided by way of illustrative examples that bring the Multi-Step Income Assertion to life.

- The non-operating and other part lists all business revenues and bills that don’t relate to the business’ principle activities.

- If operating expenses are rising disproportionately, a evaluate of administrative or marketing costs might be warranted.

- The multi-step earnings assertion details the positive aspects or losses of a business, in a selected reporting period.

- Conversely, a low or unfavorable gross revenue margin may indicate issues with pricing, production inefficiencies, or rising prices.

- The operating section is subdivided into two main sections that list the primary business revenue and bills.

It aids in trend analysis, budgeting, and strategic planning, making it an indispensable tool in monetary reporting and analysis. After figuring out and recording the non-operating revenues and bills, the following step is to regulate the working income to replicate these figures. This adjustment results in the calculation of complete earnings before taxes, also referred to as pre-tax earnings. Multi-step income statements additionally support budgeting and forecasting by offering a clear historic report of economic efficiency. They allow management to set realistic income targets and control expense budgets aligned with company objectives.

Correct classification requires a transparent understanding of the business’s operations and the nature of each income and expense item. Monetary managers have to rigorously review every item to determine its correct classification and guarantee it aligns with normal accounting practices and rules. As Soon As all working bills are listed and quantified, the subsequent step is to calculate the entire working multi step income statement example bills. Working expenses had been analyzed separately, revealing that administrative costs had been disproportionately high. The firm invested in workflow automation software to cut back handbook work, cutting operating bills by 10%. Finally, for very small or simple companies, making ready a multi-step income statement may be unnecessarily advanced in comparability with a single-step statement.

This helps in anticipating money circulate needs, funding necessities, and profitability. Segment revenue statements highlight which divisions or merchandise contribute most to gross profit and operating income, serving to management determine the place to speculate or divest. For instance, an organization could find that one product line consistently generates a higher gross margin whereas one other drains assets with low profitability.

Corporations with robust accounting profits should still face liquidity challenges if cash collections lag behind income recognition. Funding analysts use working income and internet income figures to estimate future cash flows and earnings progress. These estimates underpin valuation models corresponding to discounted money move (DCF) or price-to-earnings (P/E) ratios. Management and analysts typically scrutinize non-operating objects to grasp their nature and potential recurrence. For instance, a big one-time acquire from promoting a constructing should not be considered a part of common revenue when forecasting future earnings.

# 1 – Working Head – Gross Revenue

The multi-step earnings assertion shows essential relationships that assist in analyzing how well the corporate is performing. For instance, by deducting COGS from working revenues, you presumably can decide by what amount sales revenues exceed the COGS. If this margin, known as gross margin, is lower than desired, a company may have to increase its selling prices and/or lower its COGS. The categorized revenue statement subdivides working bills into selling and administrative bills.